Helps foreigners invest in Japanese CRE > 1M USD

© Cruysen Klinkers GK Tokyo, Japan 2023.

All rights reserved.

This is for the global thinkers

This is for the

- Finance guys and girls (traders, forex, hedge funds, options) often from UK, Singapore, Hong Kong, Switzerland with exposure to or interest in Japan.- (U)HNWI’s

- Family offices

- Pension funds

- Funds of funds

Who want great assets

Commercial real estate in Japan starting from 100M JPY (1億円) / 750k USD. Residential and mixed use. Our deal sizes are generally up to 100M USD / 15B JPY and sometimes over 1B USD / 150B JPY.

Who want to diversify

- Geographically: Japan / Asia Pacific (APAC Region)

- Currency: Japanese Yen

Who seek creativity, speed & performance

- Cash Flow

- Appreciation

- Leverage

- Cost efficiency

About Us

Cruysen Klinkers (“CK”) is a Dutch independent and privately owned boutique investment advisory, real estate developer and asset manager in Tokyo, Japan.

Company Values & Culture

Speed, Creativity and Performance.

Corporate Information

| Name | Cruysen Klinkers G.K. |

| Headquarters | 107-0062 Palace Aoyama Building 209 6-chōme-1-6 Minami-Aoyama, Minato City, Tokyo, Japan |

| Established | May 2023 |

| Director | Koen Klinkers (Representative) Tijs Cruysen |

| Capital | 5,000,000 JPY |

| Banking | Kiraboshi Bank |

| Services | 1. Buying, selling, leasing, managing and developing real estate 2. Any business incidental to the preceding item |

Licenses (including 3rd Party)

Investment Advisory

Asset Management

Brokerage

Memberships & Associations

- ULI (Urban Land Institute Japan)

- Tricor FSA Program 2023

- NCCJ (The Netherlands Chamber of Commerce in Japan)

Investment Advisory

1. Enter Japan

• Benefit from our understanding of Japanese culture and business customs to get things done

• Have FSA foreign investor licenses and/or exemptions arranged to be fully compliant early on2. Know your Limits

• Become aware of sensitivities and risks by using our underwriting specific to the Japanese market

• Maximize potential reward by our creative deal and tax incentivized structuring3. Make way in the Japanese markets

• Use our network to access discounted deals and cheap local debt at Japanese banks

• Leave it to us to communicate persuasively and close deals with the Japanese parties involved4. Strategically Stabilize

• Reposition to higher-paying tenant segments using our proprietary CK Japan AI System

• Be green from the start by our integrated Dutch approach to sustainability

Asset Management

5. Maximize Income

• Reduce non-payment and default risk by our tenants’ income and guarantor verification

• Increase revenue per tenant by keeping renewal fees in-house6. Scale

• Fill vacancy at scale with our corporate sales to foreign employers in Japan

• Save at scale on operational costs by digital contracts and digital payments (DX)7. Reduce Vacancy

• Reduce vacancy by using our proprietary tenant friend matching service

• Reduce unexpected costs through ongoing tenant conversation and complaint handling8. Perfect Exit

• Minimize surprises later on by prudent accounting audited by a western Big4

• Maximize gains by actively proposing refinancing and/or exit timing

Contact

Cruysen Klinkers G.K.

107-0062 Palace Aoyama Building 209

6-chōme-1-6 Minami-Aoyama,

Minato City, Tokyo, JapanContact us for more information through the contact form below or telephone or e-mail.Telephone: +81 (0)3 5962 6454

E-mail: info@cruysenklinkers.com

Thank you

We will get back to you within 24 hours.

外国人による日本のCREへの投資を1億円以上支援

野心ある投資者へ

ターゲット顧客

○ 金融関係の男女(トレーダー、外国為替、ヘッジファンド、オプション)は、英国、シンガポール、香港、スイス出身で、日本との取引や関心を持っていることが多いです。○ヨーロッパの超富裕層(UHNWI)

○ヨーロッパのファミリーオフィ

○ヨーロッパの年金基金

○ヨーロッパのファンドオブファンズ

素晴らしい資産が欲しい人

1億円(億円)からの日本の商業用不動産。 住宅および混合用途。

ダイバーシティを目指す方に

○地理的多様性:日本/アジア太平洋地域(APAC地域)

○通貨的多様性:円資産

高い投資パフォーマンスを求める方に

○キャッシュフロー

○資産価値の上昇

○レバレッジ

○コスト効率

CKについて

Cruysen Klinkers (「CK」) は、東京に拠点を置くオランダの独立系非公開ブティック投資顧問、不動産開発会社、資産管理会社です

企業の価値観と文化

創造性、スピード、パフォーマンス

会社概要

| 会社名 | Cruysen Klinkers 合同会社 |

| 本社所在地 | 〒107-0062 東京都港区南青山 6-1-6 パレス青山 209 |

| 設立日 | 令和5年5月30日 |

| Director | クリンカース・クン (代表社員) クルイセン タイス(ディレクー) |

| 資本金 | 5,000,000 円 |

| 取引金融機構 | きらぼし銀行 |

| 事業内容 | 1. 不動産の売買、賃貸借, 開発および管理 2. 前号に付帯する一切の業務 |

ライセンス (関連第三会社を含む)

○金融投資アドバイザリー

○資産運用

○不動産仲介

投資アドバイザリー

日本進出のサポート

○日本の文化やビジネス慣習に精通した我々が、業務進行をスムーズにサポート。

○金融庁の外国投資家ライセンスや適切な免除措置の取得をサポートし、法的適合を早期で実現。市場の把握

○アンダーライティングを活用し、日本市場独特の感受性やリスクを正確に把握。

○独自の取引メカニズムや税制優遇構造を駆使して、報酬最大化を目指す。日本市場での成功への道筋

○豊富なネットワークを活用し、割引取引や銀行の低金利資金調達をサポート。

○日本の関連企業やパートナーとの交渉において、強力なコミュニケーションを通じて取引を成功に導く。

戦略的な事業安定化

○「CK JAPAN AI SYSTEM」を活用し、より報酬の高いテナントセグメントへの配置をサポート。

○オランダ発の持続可能性に対する統合的アプローチを採用し、環境に優しいビジネス実践を推進。

資産管理

収益最大化

○テナントの収入や保証人の確認を徹底し、未払いやデフォルトリスクを低減。

○再契約料を社内で保持することで、テナント一人当たりの収益を増加規模拡大

○日本在住の外国人雇用者向けの強固な法人営業を展開し、大規模で空室率を緩和。

○デジタル契約やデジタル決済(DX推進)により、運営コストを規模的に削減。空室対策

○独自の「テナント友達マッチングサービス」を導入し、空室を効果的に削減。

○カスタマーリカバリーとクレーム対応を実施し、予期せぬテナント退去コストを削減。イグジット

○BIG4会計事務所による厳格な会計監査を受けることで、未然にリスクを回避し、予期せぬ損失を最小化。

○リファイナンスやエグジットの最適なタイミングをクライアントに積極的に提案し、収益の最大化をサポート。

お問い合わせ

Cruysen Klinkers G.K.

〒107-0062 東京都港区南青山 6-1-6 パレス青山 209以下のコンタクトフォーム、電話、またはメールで、詳細情報やお問い合わせください。Telephone: 03 5962 6454

E-mail: info@cruysenklinkers.com

Privacy Policy

プライバシーポリシー

English

Purpose of use of personal information to be acquired

We will use the email address and name obtained from your inquiry in response to that inquiry.Security Control of personal information

We will take necessary and appropriate measures to prevent leakage, loss, or damage of personal information, correct it, and otherwise manage it safely.

After responding to your inquiry, we will delete the acquired personal information within our company.Provision of personal information to third parties

We will not provide users’ personal information to third parties without obtaining their prior consent, except as required by law.Outsourcing the handling of personal information

We will not outsource the handling of personal information, in whole or in part, without obtaining the prior consent of the user.

Disclosure, etc. of personal information and contact for inquiries.At the request of the user, we will comply with requests for disclosure, notification of the purpose of use, correction, addition, or deletion of content, suspension of use, deletion, and suspension of provision to third parties of personal information held by us and disclosure of provision from and to third parties of personal information held by us.Please use the contact page for more information.日本語取得する個人情報の利用目的

当社は、お問い合わせで取得したメールアドレスとお名前を取得し、そのお問い合わせに関する回答で取得した個人情報を利用します。

個人情報の安全管理

取得した個人情報については、漏洩、滅失または毀損の防止と是正、その他個人情報の安全管理のために必要かつ適切な措置を講じます。

お問い合わせの回答後、取得した個人情報は当社内において削除致します。

個人情報の第三者提供

当社は、法令で定める場合を除き、利用者の個人情報を、あらかじめ利用者の同意を得ることなく、第三者に提供しません。

個人情報の取扱いの委託

取得した個人情報の取扱いの全部又は一部を、あらかじめ利用者の同意を得ないで、委託することはありません。

個人情報の開示等および問い合わせ窓口について

利用者からの求めにより、当社が保有する個人情報に関する開示、第三者提供の記録の開示、利用目的の通知、内容の訂正・追加または削除、利用停止、消去および第三者提供の停止に応じます。詳細については、お問い合わせページをご利用ください。

Cruysen Klinkers RecapHappy New Year and 1 year Cruysen Klinkers

It’s an interesting time. The New Year has started but soon it also marks the 1 year existence of Cruysen Klinkers.It’s the company abbreviated by you as “CK” or as the Brits call us: “Deal Team Dutch”. And in a broader perspective the journey Koen (Klinkers) and I have decided on. To create great assets in Japan as and for foreigners and make an end to the complex maze Japanese real estate can be.Kick-off May 2023 - Aug 2023

After our kick-off in May 2023 we dedicated the first 3 months to building up the goodwill, relationships and getting people to give us the advantage of the doubt. I felt like the new kid on the block in Tokyo real estate. Although Koen has had an excellent multi-decade track record in Japan real estate, I didn’t have much to offer besides my word. We did manage to set up the company and get the stamps of approval from the Japanese government.Especially Koen's and JMO’s goodwill and Koh-san (Cosmopolitan) support has been vital in this phase and I am very thankful to them.

Product Trial July 2023 - Sep 2023

We dedicated the next 3 months to deliver on our promises, to ensure product quality and delivery. We built a brokerage partnership with Oscar Volder from Azabu Property Investments (API). This allowed us to service foreigners in Japan to buy and sell real estate by a completely Dutch team.Then, we landed a trial case with our first client, a banker and trader from Singapore. We freed him from his Suruga financed, Yokohama property. At that time I didn’t even know who Suruga Bank was. But we learned fast.We changed the traditional boring marketing leaflet from selling properties to selling futures. This approach worked to attract a different buyer profile. We netted our client 8% more net capital gains (cash in hand) than our competitors were able to do.This gave us testimony as a trusted commercial real estate company in Japan. And then I took the famous “konbini martini” picture. It showed Oscar (left) and James (right) hugging each other in the 7/11 after their deal closed.

Marketing Oct 2023 - Dec 2023

I had no idea how much one picture published on the right channel could do to get eyeballs. I took it at the right moment at the right time. I first didn’t consider publishing as it’s not what you use to see on LinkedIn: would this not be too personal and vulnerable? But people loved it, it went viral, and reached tens of thousands of people. It even got interest from the press. Authenticity works!LinkedIn has been vital to us to go viral but it could only be because we built:

1) an excellent reputation;

2) a proven successful product delivery and;

3) onboarding and aftersales capabilities.And so people started talking about us, sharing our results and introducing people to us.We now have a daily stream of incoming leads, foreigners. Most are working in finance, in Singapore, Hong Kong, Switzerland. Most are from the UK, Dutch and Swiss and a handful are from the US, Canada, Australia and New Zealand.All seek help buying, selling, financing, managing or developing real estate in Japan.

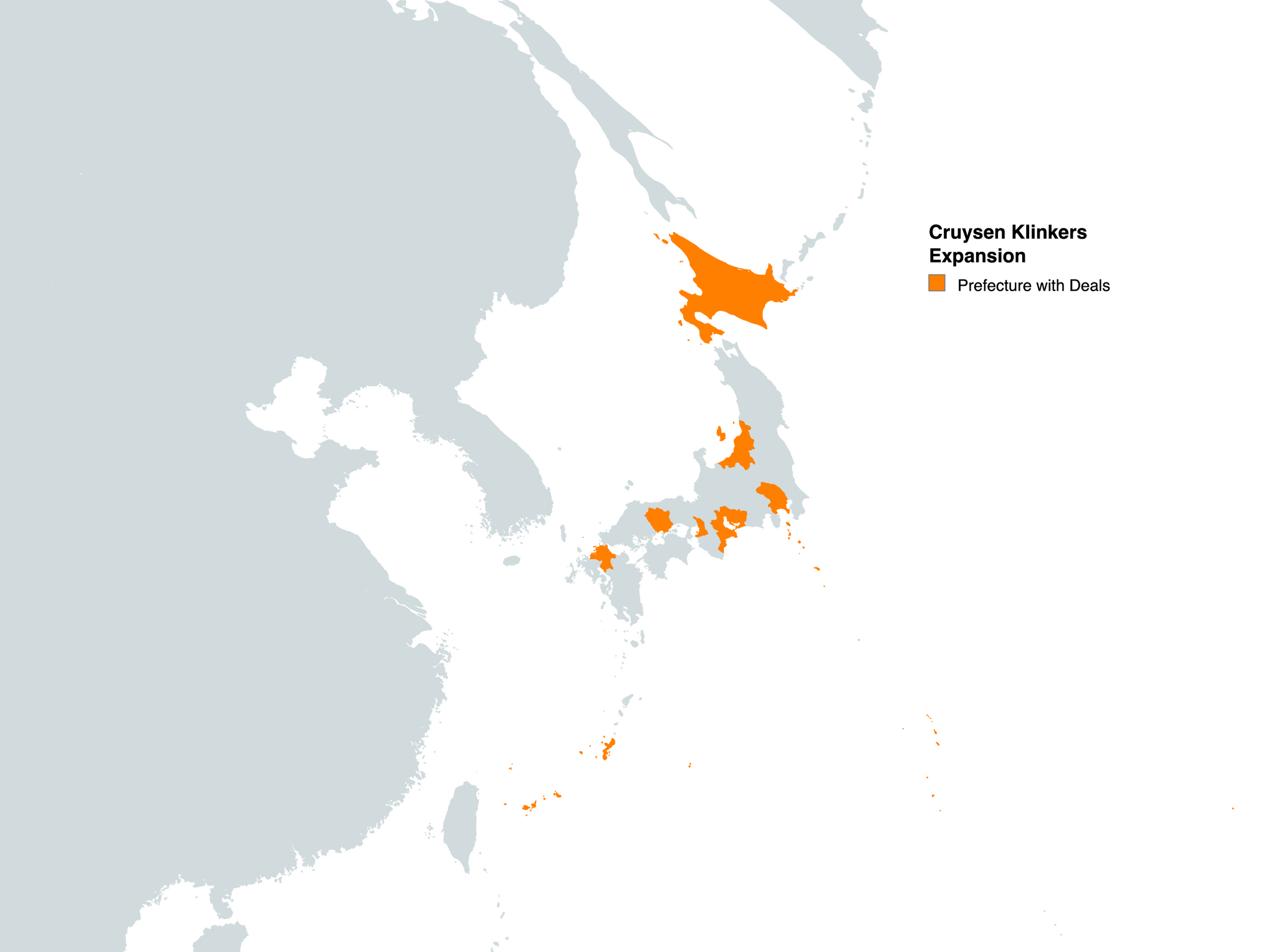

Expanding from Tokyo to whole Japan

We expanded our reach from wider Tokyo, Yokohama and Kawasaki to nationwide.We now have deals in:

- Ashikawa and Sapporo Hokkaido;

- Sendai;

- Niigata;

- Tokyo;

- Yokohama;

- Kawasaki;

- Kobe;

- Okayama;

- Mie;

- Kita-Kyuushuu;

- Fukuoka and;

- Okinawa.And next to that we kept building on the strategic side of the business.We got introduced to both Japanese and western banks in Japan. We got cultured to the Japanese way of doing big business. It enabled us to add hard to obtain commercial real estate financing to our services. The ones with the high LTV's and the low rates. With bankers we trust.We built relationships with the consulting firms. We are proud to refer clients to KPMG’s high quality deal structuring support.Finally, we commenced R&D activities with Fu Long being our latest addition to the family. He assisted us in creating our own underwriting model of Japanese real estate. He got fantastic remote support from Josh, our specialist modeller. In our experience some real estate brokers in Japan underwrite with unrealistic assumptions. We changed that as our investors judge us on the deviation of our promises, and rightfully so. It has saved us from not investing in a deal or two. Sometimes the profit is in knowing what not to get into.Fu Long also helped us to use this product as an internal tool. We overlayed it on Google Maps to find pockets of growth. This is essential in a country suffering from population collapse.

Sales Jan 2024 - Mar 2024

Now we use our creativity in the Japanese real estate market - and be even more competitive.We introduced CK Insider Deals. It is a new off market package product where we qualify, bundle and match sellers with professional bulk buyers. Buying in bulk often means better and cheaper financing for the buyer who can get higher yields that way. And it saves them a lot of time to qualify buildings in bulk instead of one by one. For the seller it means only having to deal with qualified buyers. This saves time and effort and gets them a fair price. In short everybody wins. The seller gets a good price, buyer gets better financing and bankers make higher fees with less work.Our on- and offmarket listings quadrupled to over 4.5 billion JPY / 30M USD of real estate in Japan. Our Japanese real estate financing services has grown to over 35B JPY / 250M USD in total deal opportunity. We close twice as much, far outperforming the market benchmark.We now have experience serving HNWI clients (those with over 1M USD to invest) and UHNWI (Ultra High Net Worth Individuals), those with roughly over 25M USD to invest. We help them get local Japanese financing for existing portfolios, new development and funds.

March 2024: Introducing Asset Management Capabilities

We also landed our first asset management customers. Foreigners switching from Japanese asset managers to us. They trust us more. They get full transparency on quotes like repairs and no backhandling. Compared to most Japanese asset managers, this is attractive.Next to that we built out a marketing referral program. On staffing front we are recruiting and hiring more marketing talent to help grow CK.

2040 Tokyo Real Estate Development Vision

Brokerage, financing and asset management services form the backbone of our company.

Now we are tapping into the Tokyo real estate development space.Here too we are in the very first stage. We obtained pledges and built goodwill, having people give us the advantage of the doubt. We built wonderful relationships with the FSA, the urban planning division of Tokyo City and various Ministeries. We find the Japanese are curious about the next Mori being Dutch-Japanese!Also, more and more European brands who want to enter Japan are finding us.Being new is challenging, but also means no history and no drag.

We are going to skip the concrete generation.

We go straight into building sustainable, wooden high-rise.We are not here to overhaul Japan. We only add Dutch flavor to Japan.We contribute to Japan’s society shifting from consumption first to creation first.Because socialism seems great until you run out of other people’s money. We are now figuring out capitalism is great until you run out of other people’s people. I therefore believe we as a species are switching to a new model that fundamentally supports and incentivizes creation.Creation of humanity - children - and the supporting structures.And our opportunity lies to contribute to it with beautiful large scale development projects that allow people to:

- connect with nature;

- do meaningful work;

- raise families and;

- provide unique spaces to connect with yourself and others.It is why our company’s tagline is “Asset Creators”.Because we are here to create.Excitement for the new year

We’re very proud of what we achieved so far and excited for the future!

Thank you everyone again for being part of our movement and your continuous support.よろしくお願いします。February 2024CRUYSEN Tijs

Partner

Cruysen Klinkers G.K.